Intangible Asset Percentage is the forensic measurement of the 70–90% of a modern business’s value that resides in brand equity, proprietary systems, workforce capability, and customer trust. In 2026, relying on a balance sheet that only captures tangible assets is a recipe for a 70% valuation error. This page defines the shift from “iron to intelligence explaining how we use the 25 Factors Affecting Business Valuation and 5 Senses Inspection Reports to identify and weigh the invisible drivers that generate real wealth. By quantifying this percentage, we provide a court-ready determination of Fair Market Value that traditional accounting models are physically incapable of detecting.

Intangible Asset Percentage Defined

Defensible Fair Market Value Reports in Just 10 Days - Basic Flat Fee $3,500

Interpreting the Shift in Enterprise Value Composition

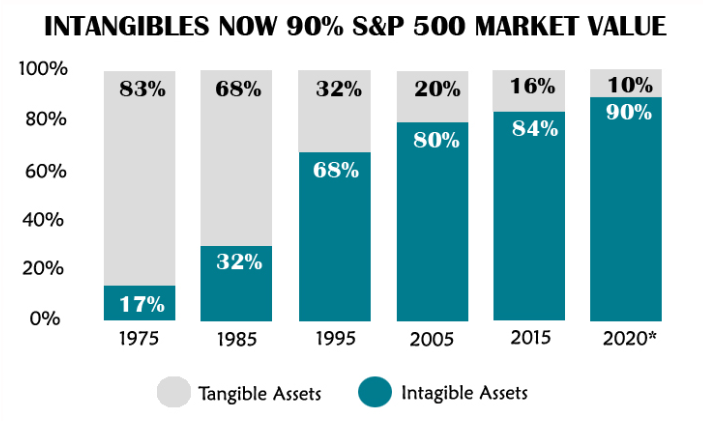

The chart above illustrates a long-term structural shift in how enterprise value is composed. In the mid- to late-20th century, business value was largely anchored in tangible assets — land, buildings, equipment, and inventory. Academic and market literature from that period commonly placed intangible assets in the mid-teens range as a proportion of total enterprise value.

Over time, as economies became more service-oriented, technology-enabled, and system-driven, that balance shifted materially. By the late 2010s and early 2020s, a growing body of evidence suggested that intangible assets often represent a substantial — and in many cases dominant — share of enterprise value, with estimates frequently extending into the upper ranges shown on the chart, depending on industry and business model.

The chart does not assert a fixed percentage. It illustrates a directional and structural change in the drivers of value.

Judicial Recognition of Intangible Value Drivers

Canadian courts have increasingly aligned valuation expectations with this economic reality. Rather than focusing on physical form alone, courts now emphasize functional substance, operational systems, and decision-making frameworks as legitimate and material contributors to value.

The following cases support the proposition that intangible assets may represent the majority of a business’s value, where supported by facts and evidence:

-

Cameco Corp. v. The Queen (2020 FCA 112)

The Federal Court of Appeal recognized that value arises from strategic decision-making and risk management, not merely from ownership of physical assets. -

Canada v. Alta Energy Luxembourg S.A.R.L. (2021 SCC 49)

The Supreme Court of Canada confirmed that modern economic value is knowledge-based and mobile, explicitly moving away from physical location as the primary measure of value. -

Suncor Energy Inc. v. Northern Sunrise County (2019 ABCA 300)

The Court held that Fair Market Value must be fully informed of all relevant facts, including non-physical value drivers where they materially affect value. -

Dow Chemical Canada ULC v. Canada (2024 SCC 23)

The Supreme Court emphasized that valuation must reflect economic reality, including systems, processes, and other intangible contributors where they drive performance. -

Lundin Mining Corp. v. Markowich (2025 SCC)

The Court ruled that internal operational changes can constitute material changes in value, validating the primacy of management systems and operational structure over static asset balances.

Why Legacy Valuation Precedent Is No Longer Binding

Some valuation disputes invoke stare decisis to argue that traditional valuation benchmarks must continue to govern. Canadian law expressly rejects that position where the factual foundations underlying earlier precedent have materially changed.

The following cases establish that courts are permitted — and in some circumstances required — to depart from outdated valuation conventions:

-

Canada (Attorney General) v. Bedford (2013 SCC 72)

The Supreme Court held that precedent may be departed from where new evidence fundamentally shifts the parameters of the debate. -

R. v. Comeau (2018 SCC 15)

The Court confirmed that precedent may be set aside where new evidence changes the understanding of the legal question. -

R. v. Sullivan (2022 SCC 19)

The Supreme Court ruled that courts must abandon rules that are no longer workable in practice. -

Ventas, Inc. v. Sunrise Senior Living REIT (ONCA)

The Court emphasized substance over form, confirming that value resides in the going concern, including systems and management capability. -

Lafarge Canada Inc. v. British Columbia (2019 BCSC 1260)

The Court rejected formulaic approaches where they failed to account for actual operational use, reinforcing the need to examine how a business truly functions.

Combined Legal Implication

Taken together, these two bodies of case law establish that:

- Enterprise value is no longer reliably measured by tangible assets alone

- Intangible assets frequently represent a substantial and sometimes dominant share of value

- The proportion of intangible value is fact-dependent, not assumed

- Courts prioritize economic reality and operational substance

- Reliance on outdated valuation conventions is not legally required when those conventions no longer reflect reality

Application to Fair Market Value

Fair Market Value requires informed, prudent parties acting at arm’s length with full knowledge of relevant facts. Where intangible assets materially influence performance, risk, and transferability, their identification and evaluation are essential to a fully informed valuation conclusion.

Modern valuation practice must therefore reflect:

- The evolved composition of enterprise value

- Judicial expectations of economic realism

- Evidence-based assessment of intangible asset presence

- Operational substance rather than historical form